The Incentive Certificate is a document that contains the characteristic values of the investment and provides the possibility of benefiting from the registered support elements if the investment is realized in accordance with these values and the determined conditions.

The incentive system started to be implemented with the Decree No 3305 on State Subsidies for Investments which entered into force on June 15, 2012, and the Communiqué No. 2012/1 on the principles and procedures regarding the implementation of the Decree on State Subsidies for Investments.

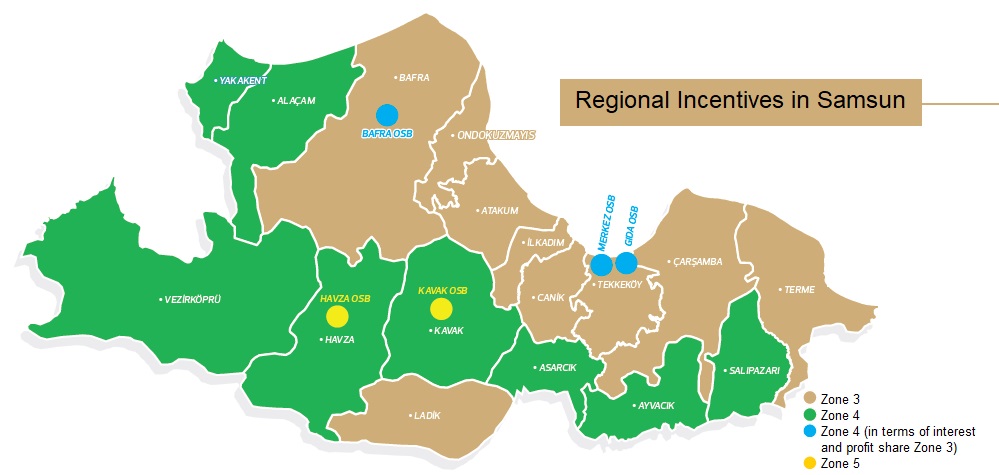

The incentive system has been created by developing and revising the old incentive system in order to ensure that the country achieves the targets of 2023 (one of the 10 largest economies in the world, $ 500 billion export, $ 25,000 per capita income), reduce import dependency on manufacturing and meet the changes demanded by private sector organizations and investors. In addition, a new 6-level regional map based on the Socio-Economic Development Ranking Study of Provinces (2011) was prepared, abandoning the 4-level regional map used in 2009. Samsun is located in the 3rd region of this map where the provinces located in the 6th region enjoys the most advantageous support elements.

In addition, it was ensured that investments to be made in some districts benefit more from incentives by making a classification at the district level.

Incentive System consists of 3 different applications. Domestic and foreign investors can equally benefit from the following incentives:

- General Investment Incentive Scheme

- Regional Investment Incentive Scheme

- Strategic Investment Incentive Scheme

Please check the investment incentive system presentation for more details.